do nonprofits pay taxes on donations

Donations to pay someones medical or educational expenses are not. These considerations provide ample reason for careful legal analysis of a nonprofits sales activities.

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

And it doesnt stop there.

. And to the extent such sales are related and regularly carried on additional UBIT liability may result too. Federal Tax Obligations of Non-Profit Corporations Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Several different kinds of taxes may apply to your business activities.

Most nonprofits fall into this category and enjoy numerous tax benefits. Nonprofit organizations are increasingly accepting Bitcoin and other cryptocurrency donations because of the favorable taxes and fees. Persons who donate goods to nonprofit charitable organizations or state or local government entities are exempt from use tax if they have had no intervening use of the goods.

Amount and types of deductible contributions what records to keep and how to report contributions. Donations to nonprofit organizations are not taxable PROVIDED the donation does not result in the granting of admission to an event or place. Recipients do not report them on their taxes.

A similar anecdote applies to individuals so long as you donate less than 15000 you dont have to pay the gift tax or report anything to the IRS. For nonprofit organizations tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade. Do i need to pay tax on donations that were given to me.

Those purchases become part of the total amount that is subject to tax. The IRS will look at the payment made to a nonprofit by a corporate sponsor and decide whether the payment is a tax-free gift charitable contribution or a taxable advertising paymentThe IRS focuses on whether the corporate sponsor has any expectation that it will receive a substantial return benefit for its payment. As of 2014 that amount was 14000.

The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the nonprofit corporations tax-exempt purposes. You may deduct any legitimate expenses associated with the fundraising. How donors charities and tax professionals must report non-cash charitable contributions.

CHICAGO IL 53 W. Most nonprofits have paid staff. An NPO does not have to register federally or provincially to acquire its tax-exempt status.

Or the provision of a taxable service such as pest control or building cleaning see the List of Taxable Services guide for additional. Take the stress out of tax prep. The extent and nature of exemptions from state taxes will vary from state to state.

If you want to schedule an event to raise money publicize this fact as it may be an excellent way to draw in donors. Some have thousands of employees while others employ a couple of key people and rely on. Do charities pay taxes.

Donations that others make to nonprofits are generally tax-deductible for those individuals but the nonprofit wont pay taxes on those donations. They also may be exempt from paying state sales tax on their purchases and from local property tax on property they use to carry out their charitable activities. Donations are tax-deductible for donors.

For example if you receive bonds as a gift you must report any interest the bonds earned after you received them. Charities generally do not pay state or federal income tax. If you were to sell those shares in order to donate the after-tax proceeds to charity you would owe 600 in federal taxes under the top long-term capital gains tax rate of 20.

Gift taxes are the responsibility of the person giving the gift. If so the payment will result in taxable income for the nonprofit. Typically in order for a donation to your organization to be tax-deductible it will first need to have secured the status of being a 501 c 3 organization though there are exceptions.

The charity can then issue charitable donation receipts for tax purposes. Sales of food meals beverages and similar items under a number of different circumstances. Goods donated to nonprofits without any intervening use are not subject to retailing BO tax or sales tax since they are given away without a charge.

View solution in original post. However this corporate status does not automatically grant exemption from federal income tax. Wineries are often asked to donate bottles of wine or other products for charitable causes.

First and foremost they arent required to pay federal income taxes. The IRS categorizes crypto as property which means taxes on crypto donations are treated the same as donations of stocks with lower tax rates than US. In most cases they wont owe income taxes at the state level either as long as they present their IRS letter of determination to the states Department of Revenue.

The transfer of property such as a meal cap book etc. A brief description of the disclosure and. So the first umbrella income related to your exempt purpose is relatively simple.

In general a person can give any individual a certain amount each year without triggering gift tax. If for example an organization pays you 200 to man a fundraising booth for them at a local fair you must report it to the IRS as earned income. Over 3359 tax filings for nonprofits of all sizes.

However this corporate status does not automatically grant. How donors charities and tax professionals must report non-cash charitable contributions. An NPO cannot issue tax receipts for donations or membership fees contributed.

A searchable database of organizations eligible to receive tax-deductible charitable contributions. The donor winery also does not owe use tax on the value of the. Although there are no taxes on donations received there are taxes on any money you receive for raising it.

Gifts or money you received as a present isnt taxable but you do owe taxes on any income it produces. Ad Experts in nonprofit bookkeeping. State tax exempt benefits vary by state but most include.

In order to do this you need to begin by filing the proper paperwork with the IRS. Note A charity whether or not it is registered cannot be an NPO under the Act. State and local property taxes state income tax and sales tax on purchases.

Jackson Blvd Suite 1734 Chicago IL. A hardware store donates an industrial pressure washer to a nonprofit community center for neighborhood cleanup. Simple flat rate fee.

Donation Receipt Template Receipt Template School Fundraisers Receipt

The Inspiring 10 Treasurers Report Template Resume Samples For Fundraising Report Template Photo Below Is Other Budget Template Budgeting Budget Spreadsheet

Sponsorship Levels Event Sponsorship Donation Letter

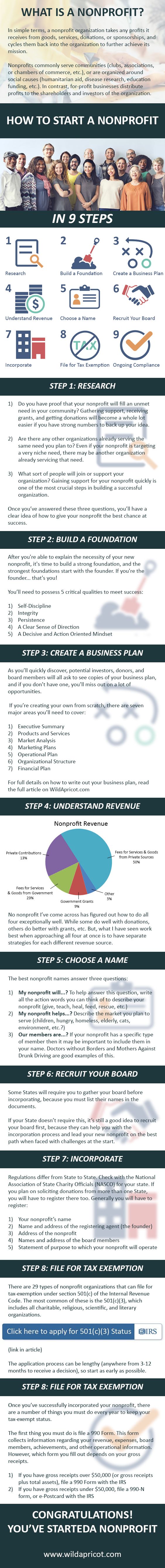

How To Start A Non Profit Organization In Pennsylvania Paperwork Cost And Time Http Localhost Inform Start A Non Profit Non Profit Nonprofit Organization

Non Profit Donation Letter For Taxes Google Search Fundraising Letter Charity Fundraising Non Profit Donations

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Sponsorship Proposal

Nonprofit Startup Checklist Nonprofit Startup Start A Non Profit Non Profit

Browse Our Example Of Non Profit Donation Receipt Template Receipt Template Donation Letter Non Profit Donations

Different Concepts For Nonprofit Organizations Start A Non Profit Nonprofit Startup Nonprofit Marketing

Pin By Michelle Higgins On Nonprofits Financial Responsibility Non Profit Executive Director

Fundraising Nonprofit Raisingfundstips Sponsorship Proposal Charitable Contributions Nonprofit Fundraising

Must Have Elements Of Every Nonprofit Mission Statement Mission Statement Examples Mission Statement Creating A Mission Statement

Non Profit Budget Budget Template Donation Letter Template Budgeting

How To Start A Nonprofit In 4 Parts Nonprofit Startup Start A Non Profit Nonprofit Management

A Brief History Of Charitable Giving Infographic Charitable Giving Infographic Charitable

Social Fundraising Tools For Nonprofits Causes Nonprofit Startup Fundraising Marketing Fundraising Activities

Charitable Donations H R Block Best Time To Study Credit Card Infographic Infographic

Difference Between Charity Business Administration Think Tank